Understanding the Importance of Spend Visibility and Categorization

Managing your organization’s finances effectively is crucial to its success. Yet, you may struggle with unclear spending patterns caused by disconnected systems, scattered data, or manual tasks. Without clear visibility into every spending category, you risk overspending, inefficiencies, and missing opportunities to save costs or optimize resources.

Spend visibility and categorization help you organize expenses into clear, visible spend categories. This makes tracking spending, cutting waste, and making better financial decisions easier.

In this blog, you’ll learn why spending visibility and categorization is vital, how they can benefit you, and strategies to overcome common challenges for better financial control and efficiency.

What is Spend Visibility?

Spend visibility gives you the ability to track, monitor, and analyze all of your organization’s spending by focusing on each visible spending category. It provides you with a detailed view of where your money goes, who is responsible for expenditures, and how well these align with your goals and budgets.

Combining data from purchase orders, invoices, and procurement systems gives you a clear, real-time view of your financial activities. This clarity, driven by the analysis of each visible spending category, enables you to make better decisions and maintain tighter control over costs.

Spend visibility involves three essential components:

- Tracking: You can monitor expenditures across your departments, teams, and projects to ensure no spending is overlooked. This includes recording all transactions, whether recurring or one-time purchases.

- Reporting: Generating reports lets you identify spending trends and anomalies. These reports can help you pinpoint excessive spending, uncover savings opportunities, and maintain compliance with your policies.

- Analysis: Proper analysis can transform raw spending data into actionable insights. This allows you to understand inefficiencies and strategically plan your budgets.

Challenges like disconnected systems, manual work, or old tools can make it hard to see where your organization is spending. Addressing these barriers will be key to achieving spend visibility.

Now that we understand the components and challenges of achieving spend visibility, let’s delve into why this capability is essential for businesses seeking to optimize financial management.

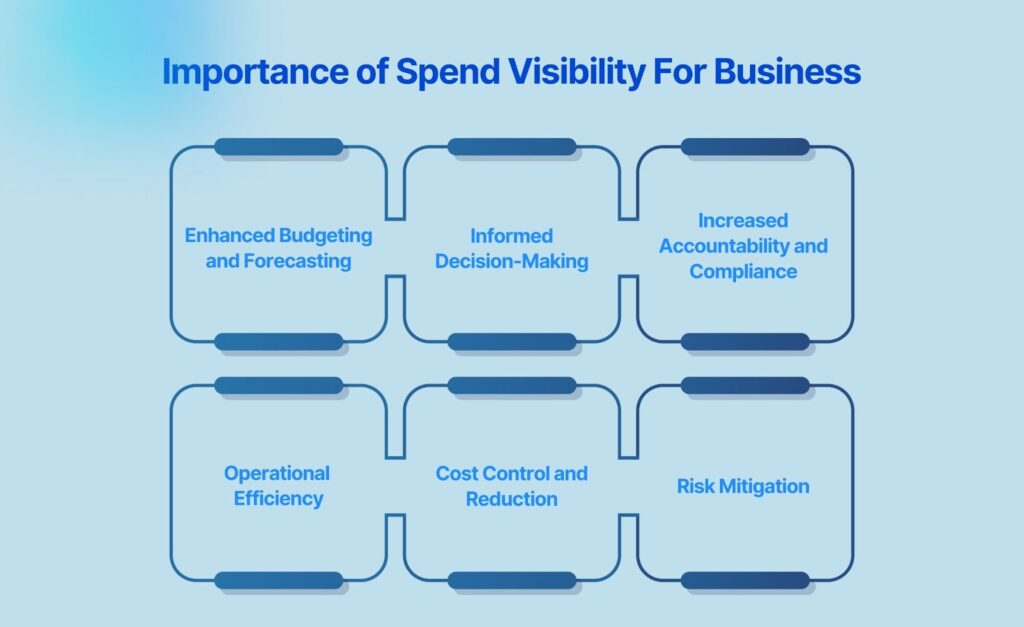

Importance of Spend Visibility For Busines

Spend visibility is crucial if you want to optimize financial management and align your expenditures with strategic objectives. It lets you understand spending patterns and make data-driven decisions that drive efficiency.

- Enhanced Budgeting and Forecasting: Real-time expenditure data tied to each visible spending category gives you the ability to budget accurately and forecast effectively. You can proactively adjust your budgets to respond to changing conditions.

- Informed Decision-Making: Having up-to-date spending data enables you to identify and eliminate unnecessary expenses promptly, helping you make smarter decisions.

- Increased Accountability and Compliance: By transparent spending, you can ensure everyone adheres to company policies and regulations. This helps you hold departments accountable and reduce the risk of violations.

- Operational Efficiency: Automating spend tracking saves you time, reduces errors, and allows your team to focus on strategic priorities.

- Cost Control and Reduction: Spend visibility, when combined with a focus on visible spending categories, lets you spot areas of overspending and identify opportunities to cut costs without sacrificing quality.

- Risk Mitigation: By closely monitoring spending, you can detect fraud or non-compliance early, protecting your organization’s financial health.

Now that you understand the benefits of spend visibility, let’s look at why categorizing your spending is equally important.

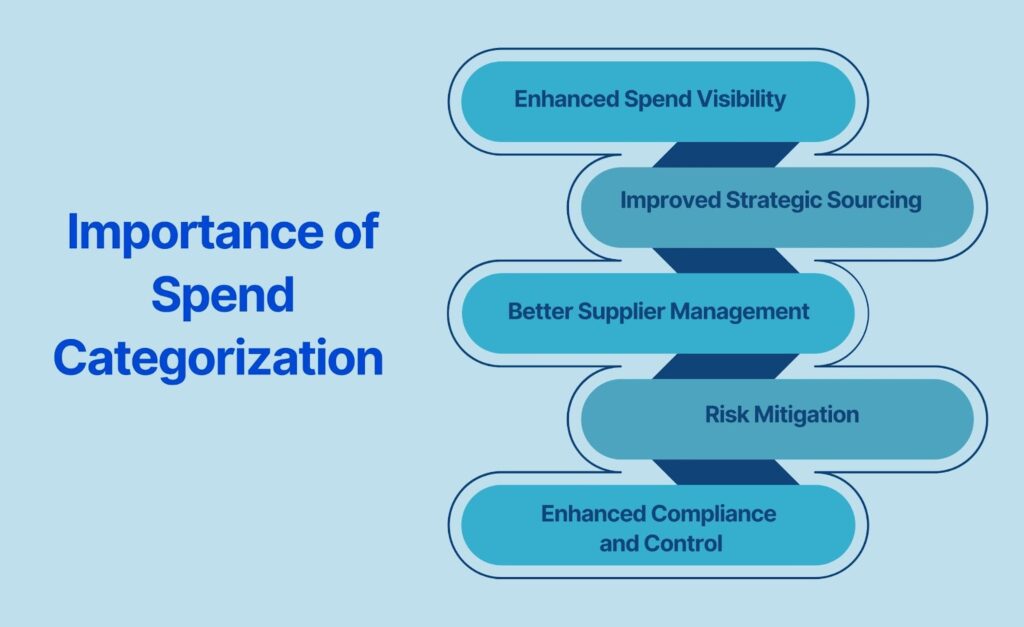

Importance of Spend Categorization

Spend categorization helps you systematically organize expenditures into specific groups based on the type of goods or services you procure. This practice is essential if you want to manage procurement and finances effectively. Here’s how it benefits you:

- Enhanced Spend Visibility: Categorization helps you clearly see where your resources are being allocated so you can identify patterns and areas for improvement.

- Improved Strategic Sourcing: By understanding expenditures in each category, you can develop better sourcing strategies, negotiate with suppliers, and achieve cost savings.

- Better Supplier Management: You can assess supplier performance for each category, enabling you to consolidate suppliers and build stronger relationships.

- Risk Mitigation: Categorizing your spending helps you identify dependencies and vulnerabilities, allowing you to develop strategies to mitigate risks.

- Enhanced Compliance and Control: A structured spend taxonomy ensures you classify expenditures properly, reducing misallocated funds and improving adherence to policies.

Despite these advantages, achieving spend categorization can still take time and effort. Let’s explore the common obstacles and how you can overcome them.

Challenges in Achieving Spend Visibility

If you’re aiming for comprehensive spend visibility, you may encounter several hurdles along the way:

- Data Silos: Is your data scattered across departments or systems? These silos can prevent you from obtaining a complete view of your spending.

- Manual Processes: Outdated methods, like spreadsheets, can slow you down and lead to errors in your financial data.

- Inconsistent Data Entry: Variations in how spending is recorded can lead to misclassifications and inaccuracies, making analysis difficult.

- Lack of Integrated Systems: Without a unified platform, you may struggle to consolidate and analyze your spending data effectively.

- Tail Spend Management: Are you managing many low-value transactions? These small expenses can add up and are often overlooked, leading to missed savings opportunities.

If these challenges sound familiar, keep reading to learn how akirolabs can help.

Strategies to Improve Spend Visibility

Improving spend visibility helps organizations manage money better and save costs. Here are some simple and effective strategies to achieve this:

- Use Centralized Software

Invest in tools or platforms that bring all spending data into one place. This makes it easier to see and manage expenses across the organization. - Automate Data Collection

Automating tasks like tracking expenses, processing invoices, and managing purchase orders reduces errors and saves time. It also ensures spending data is always up to date. - Connect with Existing Systems

Link spend management tools with your current ERP or finance systems. This creates a smooth flow of information and makes operations more efficient. - Combine All Spending Data

Gather all spending information in one system or platform. This helps create a clear picture of where the money is going and improves transparency. - Use Standard Reports

Set up the same reporting format for all teams. This makes it easier to analyze spending and find patterns or unusual expenses. - Monitor Spending in Real Time

Real-time tools show you spending as it happens. This helps teams quickly spot problems and fix them before they grow. - Work Together Across Teams

Spend visibility isn’t just for the finance team. Encourage all departments to work together, share information, and follow the same spending goals.

These simple steps will help organizations track their spending better, make smarter decisions, and save money.

Best Practices for Spend Categorization

Spend categorization helps organizations understand their expenses and find ways to save money.

Here are some easy-to-follow practices:

- Define Clear Rules and Guidelines

Set clear rules for categorizing spending. This ensures that everyone uses the same system and that data is kept accurate. - Work with Finance Teams

Collaborate with finance teams to improve spending data. Their knowledge helps refine categories and ensures correct classification. - Review and Update Categories Often

Update spend categories regularly to match business changes. This keeps the system relevant and effective.

These practices allow organizations to get better insights, find cost-saving opportunities, and make smarter financial decisions.

How can akirolabs help with Spend Visibility and Categorization?

akirolabs is a strategic procurement platform that integrates spend visibility and categorization into its comprehensive category management approach. While not solely focused on spend visibility or categorization, the platform simplifies these processes as part of its broader strategic procurement framework.

Here’s how:

1. Achieving Spend Visibility through Strategic Procurement

akirolabs equips organizations with tools to gain deeper insights into their spending patterns:

- Holistic Data Integration: By combining internal procurement data with external market intelligence, akirolabs provides a complete picture of spending trends and behaviors.

- Strategic Scenario Modeling: The platform allows teams to analyze spending in the context of broader organizational goals, ensuring that expenditures align with strategic objectives.

2. A Flexible Categorization Framework

akirolabs allows organizations to streamline categorization processes with a dynamic and adaptable framework:

- Using Existing Category Taxonomies: The platform integrates seamlessly with an organization’s predefined procurement structures, ensuring consistency across categories.

- Beyond Traditional Categories: It allows procurement teams to move beyond rigid classifications, focusing instead on strategic priorities like sustainability, innovation, and risk mitigation.

3. Collaborative Spend Management

akirolabs promotes collaboration to enhance the efficiency of spend visibility and categorization:

- Engaging Stakeholders: By involving stakeholders across departments early in the process, the platform fosters transparency and a shared understanding of spending priorities.

- Unified Strategy Development: Centralized workflows align spend categorization with an organization’s overall procurement strategy, ensuring everyone is on the same page.

4. Supporting Sustainability and ESG Goals

akirolabs aligns spend visibility and categorization with sustainability and ethical procurement goals:

- ESG Metrics Integration: Procurement teams can assess how categorized expenditures align with environmental, social, and governance (ESG) objectives.

- Procurement with Purpose (PwP): The platform helps organizations prioritize sustainable and ethical decisions by embedding ESG metrics into spend categorization and analysis.

Conclusion

akirolabs helps organizations achieve spend visibility and effective categorization by enabling the use of existing category taxonomies within a dynamic framework. This approach aligns spending with strategic priorities such as sustainability, risk management, and operational efficiency. By integrating spend data into category management workflows, akirolabs ensures that categorization is both practical and strategically valuable.

If you’re ready to take your procurement strategies to the next level, akirolabs provides the tools and expertise to help you succeed.